Request a demo to see how Bloomberg Tax Provision untangles ASC 740’s complexity. Using the valuation method, the accounts receivable of Company ABC must be brought down to its carrying value and a journal entry to record the Allowance for Doubtful Accounts of $5,000 must be entered. The carrying amount of these assets and liabilities are a result of the pairing between assets and liabilities accounts. valuation account For instance, companies that use FIFO assume that the goods purchased or produced first are the ones sold or used first, leading to a more accurate representation of current inventory costs during inflationary periods. This account plays a crucial role in ensuring that all liabilities are properly recognized, measured, and presented in financial reports in accordance with accounting standards.

Industry Products

The choice between FIFO and LIFO methods significantly impacts a company’s financial statements, affecting metrics such as profitability, tax liabilities, and inventory turnover. A Liability Valuation Account is employed in accrual and cost accounting to accurately assess and record the value of liabilities within a company’s financial statements. Market values play a significant role in asset valuation as they provide a real-time reflection of what these assets could fetch in the current market. This helps in avoiding overvaluing or undervaluing assets, ensuring that financial statements present a true and fair view. On the other hand, Asset Valuation Accounts focus on determining the worth of a company’s assets such as property, equipment, and intangible assets. These valuations are fundamental for understanding the financial health and worth of a company.

- These accounts help in recognizing any fluctuations in asset values due to market dynamics or impairment, thus allowing for a more transparent and realistic assessment of the company’s financial health.

- If given a choice between the two bonds, virtually all investors would buy the government bond rather than the small-firm bond because the first is less risky while paying the same interest rate as the riskier second bond.

- The updated quarterly or yearly accounting valuation information is made available in the form of financial statements and can be found in the investor relations area of most publicly trading firms’ websites.

- Among other metrics, an analyst placing a value on a company looks at the business’s management, the composition of its capital structure, the prospect of future earnings, and the market value of its assets.

- The purpose of a valuation account is to ensure accurate representation of asset, liability, and equity values in a company’s financial records.

Improving Your Accounts Receivable Turnover Ratio

Stocks are often valued based on comparable valuation metrics such as the price-to-earnings ratio (P/E ratio), price-to-book ratio or the price-to-cash flow ratio. For a valuation using the discounted cash flow method, one first estimates the future cash flows from the investment and then estimates a reasonable discount rate after considering the riskiness of those cash flows and interest rates in the capital markets. Next, one makes a calculation to compute the present value of the future cash flows. These accounts play a crucial role in reflecting the true value of a company’s assets and liabilities. By properly valuating assets and accounting for intangible factors such as brand reputation, they provide a more accurate representation of a company’s financial health.

What potential impact can valuation accounts have on a company’s financial statements?

One way to think about these ratios is as part of the growing perpetuity equation. A growing perpetuity is a financial instrument that pays out a certain amount of money each year—which also grows annually. Imagine a stipend for retirement that needs to grow every year to match inflation. The growing perpetuity equation enables you to find today’s value for that financial instrument. Whether you’re planning to buy, sell, or simply enhance your business’s strategic planning, understanding valuation is key to navigating the financial landscape with confidence. A comparables approach is often synonymous with relative valuation in investments.

We are looking for a strategic and results-oriented Sales Director to lead our sales efforts across value retailers (e.g., discount stores), grocery chains, and drug stores. This role is instrumental in expanding our toy consumer product presence within high-volume, fast-moving consumer channels. The ideal candidate will have extensive experience in consumer products sales, a deep understanding of the Value, Food and Drug retail environments, and the ability to manage complex partnerships and deliver sustainable, profitable growth.

Market cycles lead to constant mispricing

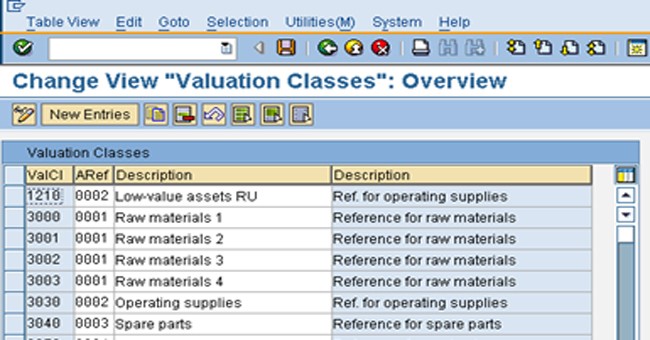

One of the main characteristics and innovation highlights compared to the Classic Valuation Runs is, that all Advanced Valuation Runs are posting onto the reconciliation account maintained in the business partner. The major benefit of this new approach is that e.g. for the Advanced Valuation Runs, all effects (from Foreign Currency Valuation, from Credit-Risk-Based Impairment, from Discounting) can be found in one account. Apart from that, the number of G/L accounts will be reduced which from another point of view reduces the maintenance effort.

A company’s market capitalization would be $20 million if its share price is $10 and the company has two million shares outstanding. The updated quarterly or yearly accounting valuation information is made available in the form of financial statements and can be found in the investor relations area of most publicly trading firms’ websites. Asset valuations can be heavily influenced by subjective judgements, particularly for intangible assets such as goodwill. Advanced valuation in financial accounting jobs use the delta posting logic only.

The P/E ratio calculates how expensive a stock price is relative to the earnings produced per share. An actuarial valuation is a type of appraisal of a pension fund’s assets versus its liabilities, using investment, economic, and demographic assumptions for the model to determine the funded status of a pension plan. In many ways, actuarial value is the equivalent of accounting value in the context of pension fund accounting. Accounting valuation is critical to financial analysis in order to generate accurate and reliable financial statements.