If a comparable company with similar growth prospects was recently acquired for a certain price-to-revenue multiple, you could apply the same multiple to the revenue of the startup you’re valuing to estimate its worth. Such clarity in financial reporting is essential for making informed business decisions and for complying with accounting standards and regulations. When examining earnings, financial analysts don’t like to look at a company’s raw net income profitability. It’s often manipulated in a lot of ways by the conventions of accounting, and some can even distort the true picture. While Tesla’s market capitalization is higher than Ford and GM, Tesla is also financed more from equity.

FAR CPA Practice Questions: Capital Account Activity in Pass-through Entities

Despite the risk of manager bias, equity investors and creditors prefer to know the market values of a firm’s assets—rather than their historical costs—because current values give them better information to make decisions. These valuation accounts play a crucial role in determining the overall financial health of a company. By accurately valuing assets and accounting for depreciation, they provide important insights into the company’s ability to generate cash flow. The proper treatment of depreciation ensures that the cash flow statement reflects the true financial liquidity of the business, helping investors and stakeholders assess the company’s performance and sustainability over time. Businesses or fractional interests in businesses may be valued for various purposes such as mergers and acquisitions, sale of securities, and taxable events. When correct, a valuation should reflect the capacity of the business to match a certain market demand, as it is the only true predictor of future cash flows.

- Asset valuations can be heavily influenced by subjective judgements, particularly for intangible assets such as goodwill.

- By maintaining these valuation accounts, companies can recognize any changes in asset values over time, which is crucial for decision-making and financial analysis.

- Market capitalization is one of the simplest measures of a publicly traded company’s value.

Fisher Price Classics

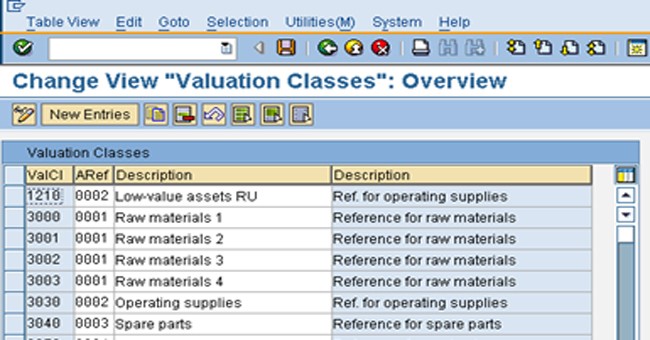

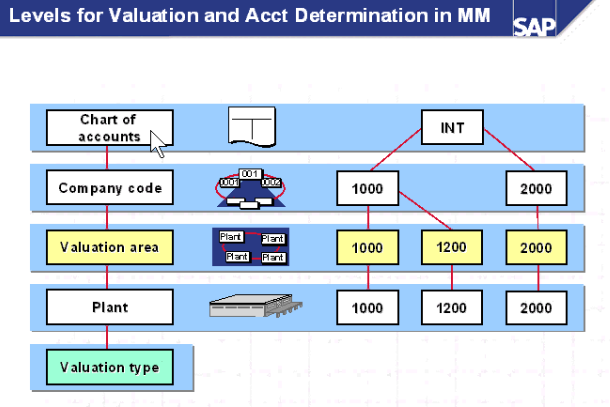

For the Advanced Valuation Runs, SAP provides the function to handle errors with the restart capability. The users get informed in the result list which items have not been processed successfully as well as why these items haven’t been processed properly. If for example, Company ABC has sold the bond above for $4,500 which is less than the face value of the bond, it means that the company sold at a discount. Company ABC has determined that they have an obsolete inventory worth $3,000 but has identified that it can be sold for $700. In this case, the carrying value of the bonds will begin at $97,000, since the $100,000 in Bonds Payable is offset by the $3,000 debit in Discount on Bonds Payable. The net amount may also be referred to as the carrying amount or the net realizable amount.

AccountingTools

This method is most appropriate in situations where there are no significant intangible assets, or when a company is voluntarily liquidating its assets as a result of ceased operations. Financial statements prepared in accordance with generally accepted accounting principles (GAAP) show many assets based on their historic costs rather than at their current market values. For instance, a firm’s balance sheet will usually show the value of land it owns at what the firm paid for it rather than at its current market valuation account value. But under GAAP requirements, a firm must show the fair values (which usually approximates market value) of some types of assets such as financial instruments that are held for sale rather than at their original cost. When a firm is required to show some of its assets at fair value, some call this process “mark-to-market”. But reporting asset values on financial statements at fair values gives managers ample opportunity to slant asset values upward to artificially increase profits and their stock prices.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Valuation accounts affect the cash flow statement by considering asset valuations, depreciation, and other factors that impact the company’s financial liquidity. Asset valuation plays a key role in finance and often consists of both subjective and objective measurements. The value of a company’s fixed assets—also known as capital assets or property plant and equipment—is straightforward to value based on their book values and replacement costs. Corporations use asset valuation when they apply for loans, and banks review it during their credit analysis. An example of a valuation account based on a liability is the Discount on Bonds Payable, whose debit balance is combined with Bonds Payables’ credit balance to get the carrying amount of the company’s bonds.

Accounting Valuation: What it is, How it Works

Companies must record a valuation allowance against a deferred tax asset if it is more likely than not that the deferred tax asset won’t be recognized by the taxing authority. Valuation allowances impact the ASC 740 provision for income taxes required by U.S. Like most tax provision topics, correctly recording valuation allowances requires tax and accounting expertise. Balance sheet accounts are those that deal with transactions related to assets, liabilities, and owner’s equity, aka the three variables that make up the accounting equation.

Accounting entries are used to update these valuation accounts regularly, ensuring that the financial statements reflect the most current status of the company’s assets and liabilities. By adhering to accounting principles such as the matching principle and conservatism, valuation accounts enhance the transparency and reliability of financial reporting. Valuation accounts play a crucial role in ensuring that the reported values of assets, liabilities, and equity accurately reflect their true economic worth. These accounts are often used for adjustments such as recording bad debt provisions, revaluing inventory, or accounting for depreciation.

A valuation account contains an offsetting negative balance that reduces the carrying amount of the asset or liability account with which it is paired. The result of this account pairing is a net balance, which is the carrying amount of the underlying asset or liability. The valuation account concept is useful for estimating any possible reductions in the values of assets or liabilities prior to a more definitive transaction that firmly establishes a reduction. This account plays a crucial role in determining the true worth of a business’s inventory by accounting for various factors that impact asset value over time. By factoring in depreciation, which reflects the decrease in value of tangible assets due to wear and tear, the Inventory Valuation Account ensures that inventory values accurately represent their current worth.